How to Borrow Money From Cash App on Android and iPhone

How to borrow money from Cash App (on android and iPhone):

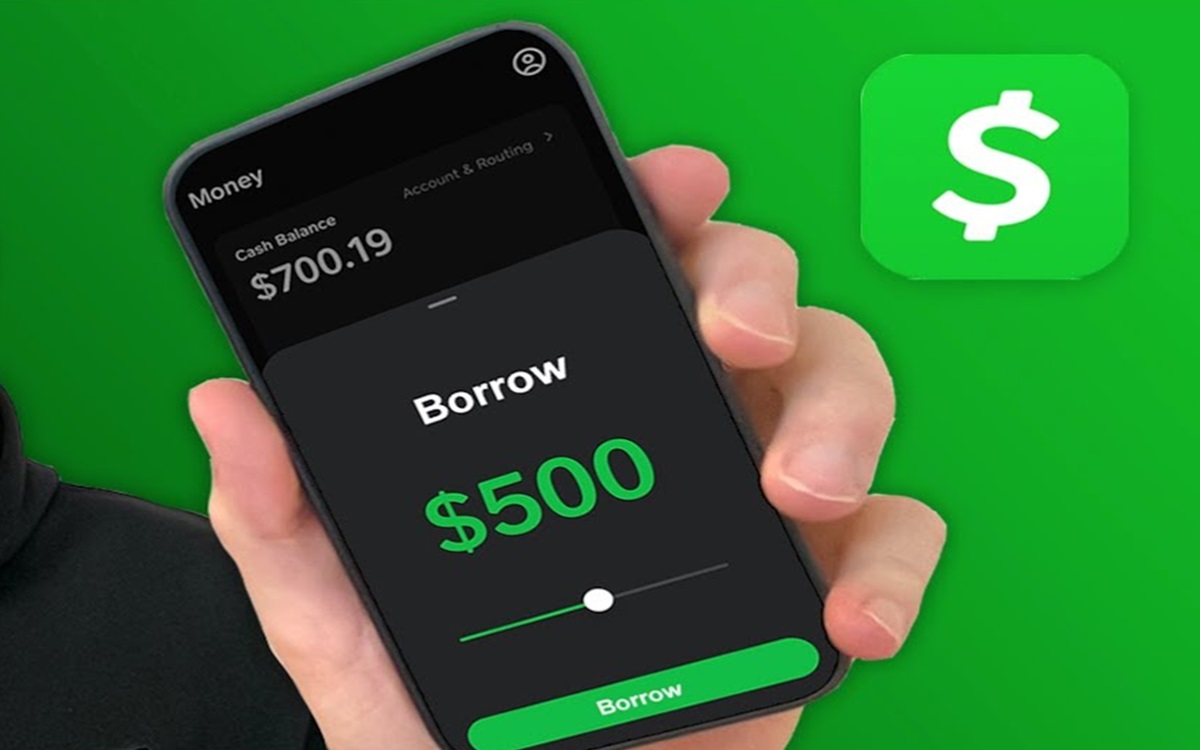

Are you using Cash App? If so, you should check out one of its newest features: Quick micro-loans of up to 200$.

Cash App now offers a convenient borrowing feature called Cash App Borrow. With this feature, users can take out short-term loans of up to $200.

Whether you’re using an Android or iPhone, you can access this quick-loan option very easily, and get the funds you need quickly.

The loan terms and requirements are simple: Cash App Borrow loans must be repaid within four weeks, and there is a 5% flat fee associated with the loan. To be eligible for Cash App Borrow, you need to have a verified account, actively use the app, and have a good credit history.

What we will cover:

- How to borrow money from Cash App on Android and iPhone

- Loan terms, including repayment period and fees

- Eligibility criteria for Cash App Borrow

- Availability of Cash App Borrow feature in your state

- Tips for getting approved for a loan on Cash App

How does Cash App Borrow work?

Cash App Borrow is a convenient feature that allows eligible users to request short-term loans directly through the Cash App. Here’s a breakdown of how Cash App Borrow operates:

Cash App Loan Amount and Repayment Terms:

With Cash App Borrow, you can request a loan amount ranging from $20 to $200. In some case up to 450$ can be borrowed. This is the highest I have seen. The Cash App AI determines how much you can borrow. Once approved, the loan must be repaid within four weeks. It’s important to note that a 5% flat fee is charged when borrowing the funds. Additionally, if the loan is not repaid by the due date, a 1.25% finance charge per week will be applied.

Flexible Repayment Options.

Cash App offers users the flexibility to choose their preferred repayment plan. You can opt for repayment as you receive cash, meaning you repay the loan in smaller increments each time you receive money through the app. Alternatively, you can select equal weekly payments, dividing the total loan amount and fees into four equal installments.

Always Review the Loan Terms and Fees!

Before accepting a loan through Cash App Borrow, it’s crucial to carefully review the loan details and understand the associated terms and fees. This includes being aware of the repayment schedule, the specific flat fee charged, and the consequences of late repayment. Taking the time to familiarize yourself with these details will ensure you can borrow responsibly and meet your financial obligations.

Cash App Loan Terms and Fees:

| Loan Amount | Repayment Terms | Flat Fee | Finance Charge (if late) |

|---|---|---|---|

| $20 – $200 | Within four weeks | 5% | 1.25% per week |

How to Borrow Money From Cash App on Android:

Do you want to borrow money from Cash App on your Android device? Follow these simple steps to get started:

- Launch the Cash App on your Android device.

- Tap on the Money tab, which is represented by a bank building icon.

- If you meet the eligibility criteria, you will see a Borrow option. Tap on it and then tap Unlock.

- Choose the amount you want to borrow and select a repayment plan that suits your needs.

- Review the loan details carefully to ensure you understand the terms and fees associated with borrowing.

- Once you’re satisfied, tap Borrow Instantly to proceed.

- Voila! The borrowed funds will be deposited into your Cash App account, ready to use.

It’s that easy to borrow money from Cash App on your Android device. Just make sure to meet the eligibility criteria and carefully review the loan terms to make informed borrowing decisions.

Eligibility Criteria for Cash App Borrow Activation:

| Criteria | Requirements |

|---|---|

| 1. Verified Account | Your Cash App account must be verified with a valid email address, phone number, and linked bank account. |

| 2. Active User | You must be an active user of the Cash App, regularly using its features and services. |

| 3. Good Credit History | A good credit history is essential to qualify for Cash App Borrow. It reflects your financial responsibility and repayment capability. |

By meeting these requirements and following the borrowing steps, you can easily access the Cash App Borrow feature on your Android device.

Still now sure how it works? Watch this quick video on the Cash App Borrow function:

How to Borrow Money From Cash App on iPhone:

Want to borrow money from Cash App on your iPhone? Follow these simple steps to access the borrowing feature:

- Open the Cash App on your iPhone.

- Tap on the Money tab, which is represented by a bank building icon.

- If you meet the eligibility criteria, you will see a Borrow option. Tap on it and then tap Unlock.

- Select the amount you want to borrow and choose a repayment plan that best suits your needs.

- Review the loan details to ensure you understand the terms and conditions, including any associated fees.

- Lastly, tap Borrow Instantly to complete the loan request.

Once your loan is approved, the borrowed funds will be deposited directly into your Cash App account.

Borrowing money from Cash App on your iPhone is quick and convenient. Remember to borrow responsibly and only borrow what you need to avoid unnecessary debt. Repaying the loan on time is crucial to avoid additional fees and penalties. If you have any questions or issues regarding your loan, don’t hesitate to reach out to Cash App customer support for assistance.

What are the Requirements for Getting a Loan on Cash App?

How do you qualify for borrowing on Cash App?

To qualify for borrowing on Cash App, you need to meet certain criteria. These eligibility requirements ensure that Cash App can offer loans responsibly and to individuals who are likely to repay them. The following are the key qualifications:

- Verified account: You need to have a verified Cash App account. Verification involves confirming your identity and providing necessary documentation.

- Active user: You must be an active user of Cash App, regularly using the app for transactions and other financial activities.

- Good credit history: Cash App considers your credit history when determining your eligibility. A positive credit history improves your chances of qualifying for a loan.

- Be a US resident aged 18 or older

In addition to the above criteria, Cash App also takes into account other factors such as your deposit and transfer activity on the app. The specific requirements may vary based on your location and Cash App’s policies. Cash App Borrow is now available in all states.

By meeting these requirements, you can increase your chances of being approved for a loan on Cash App. In my experience, almost all requests gets approved, if you have a decent record of regular money coming in, and paying back early.

Cash App Borrow Eligibility Criteria:

| Eligibility Criteria | Description |

|---|---|

| Verified Account | You must have a verified Cash App account to be eligible for borrowing. |

| Active User | You should regularly use Cash App for transactions and other financial activities. |

| Good Credit History | A positive credit history improves your chances of qualifying for a loan. |

| Deposit and Transfer Activity | Cash App considers your deposit and transfer activity on the app to determine eligibility. |

| Availability | Cash App Borrow may is now available in all states, as per 2024 |

Tips for Borrowing Money from Cash App.

When using Cash App to borrow money, it’s important to approach the process responsibly. Here are some tips to help you navigate the borrowing process:

1. Only borrow what you need

While it may be tempting to borrow the maximum amount available, it’s wise to borrow only what you truly need. By borrowing responsibly, you can avoid unnecessary debt and ensure you can comfortably repay the loan.

2. Repay on time or early.

To avoid additional fees and penalties, it’s crucial to repay your loan on time. Set reminders or enable auto-payments to help you stay on track with your repayment schedule. Timely repayment also helps maintain a positive credit history.

3. Understand the terms

Before accepting a loan on Cash App, carefully read and understand the terms and conditions. This includes reviewing the repayment schedule, interest rates, and any associated fees. Being aware of the terms will help you make informed borrowing decisions.

4. Use strong security measures

Take steps to protect your Cash App account and personal information. Create strong, unique passwords, and consider enabling security features like two-factor authentication. By implementing these measures, you can reduce the risk of unauthorized access.

5. Contact customer support if needed

If you have any questions or encounter issues with your loan on Cash App, don’t hesitate to reach out to the customer support team. They can provide guidance, answer your inquiries, and resolve any concerns you may have.

6. The Cash App loan algorithm determines your eligibility, and it changes.

It depends on your history balance, if you are not on Direct Deposit. The Direct Deposit algorithm is based on the pay-rate. The “Cash App account in good standing per risk” metric is based on: Balance history and Transaction history. I recommend that you keep a few hundreds of dollars in the Cashapp at all times. Also try to send money frequently. It also helps if you fund your Cash App account with a bank, and not just another Cash App. Lastly, pay back the money early, if you can. This improves your ‘score’ and the amount you can borrow in the future.

Cas App Borrow – FAQ.

What is Cash App Borrow?

Cash App Borrow is a short-term lending feature offered by Cash App, a popular mobile payment app. It allows eligible users to borrow up to $200 with a repayment period of up to four weeks. The loan application process is quick and easy, and the funds can be accessed instantly.

How does Cash App Borrow work?

Cash App Borrow allows eligible users to request short-term loans from $20 to $200. The loan must be repaid within four weeks and has a 5% flat fee. Failure to repay by the due date incurs a 1.25% finance charge per week. Repayment plans can be customized, and there are options to pay as you receive cash or make equal weekly payments.

How do I borrow money from Cash App on Android?

To borrow money from Cash App on Android, launch the app, tap on the Money tab, and if eligible, select the Borrow option. Choose the loan amount, repayment plan, review the details, and tap Borrow Instantly. The borrowed funds will be deposited into your Cash App account.

How do I borrow money from Cash App on iPhone?

To borrow money from Cash App on iPhone, open the app, tap on the Money tab, and if eligible, select the Borrow option. Choose the loan amount, repayment plan, review the details, and tap Borrow Instantly. The borrowed funds will be deposited into your Cash App account.

How do you qualify for borrowing on Cash App?

To qualify for borrowing on Cash App, you need a verified account, active usage of the app, and a good credit history. Factors such as deposit frequency and money transfers also influence eligibility.

What are the requirements for getting a loan on Cash App?

To get a loan on Cash App, you need a verified Cash App account, active usage of the app, and a good credit history.

How do I get a loan from Cash App.

- Check eligibility: Before you can borrow money from Cash App, you need to make sure you are eligible. The app will assess your creditworthiness and transaction history to determine if you qualify.

- Update your Cash App information: Ensure your Cash App profile is up-to-date with your accurate name, address, and phone number.

- Open the Borrow tab: Access the Cash App Borrow feature by tapping the ‘Borrow’ icon located in the Banking section of your Cash App app.

- Review the terms and conditions: Carefully review the loan terms and conditions, including the interest rate, repayment schedule, and any potential fees.

- Submit your application: Once you understand the terms, you can submit your loan application by providing basic information about your income and employment.

- Receive approval or denial: Cash App will review your application and notify you if you are approved or denied for the loan.

Is Cash App Borrow available to all users?

No, Cash App Borrow is not available to all users. The app is selective in who it approves for loans based on factors such as creditworthiness, transaction history, and income verification.

How do I repay a Cash App loan?

Repayments for Cash App Borrow loans are automatically scheduled weekly through your linked bank account. You can also make early or multiple payments if you wish.

When does it make sense to use Cash App Borrow?

Cash App Borrow can be a viable option for short-term financial needs, such as unexpected expenses, covering a gap between paychecks, or consolidating small debts. However, it’s crucial to only borrow what you can afford to repay promptly.

Is Cash App Borrow safe?

Cash App Borrow is a secure option as it utilizes advanced encryption and fraud protection measures. Your personal information is protected and stored within the app’s secure environment.

How much can you borrow from Cash App?

The maximum loan amount you can borrow from Cash App is currently $200. However, with a good ‘score’ and papack rate, it may be increased up to 450$.

How do I qualify to use Cash App Borrow?

Cash App Borrow eligibility criteria include:

- Being a US resident aged 18 or older

- Having a valid Cash App account with a linked bank account

- Maintaining a positive transaction history within Cash App

- Having an acceptable credit score

Why can’t I borrow money from Cash App?

There are several reasons why you may not be eligible for Cash App Borrow:

- You may not meet the minimum age requirement.

- You may not have a linked bank account.

- Your Cash App transaction history may not meet the requirements.

- Your credit score may not be sufficient.

Does using Cash App Borrow affect your credit score?

Yes, using Cash App Borrow can affect your credit score. The app reports your loan payments to credit bureaus, and timely repayments can positively impact your creditworthiness. However, missed or late payments can negatively impact your credit score.

What happens if you don’t pay Cash App Borrow back?

If you fail to make timely payments on your Cash App Borrow loan, you may face serious consequences, including:

- Late fees and increased interest rates

- Collection actions and legal fees

- Damage to your credit score

- Potential wage garnishment or bank account levies

Please share your experiences with the Cash App Borrow function in the comment section.