CFPB – What is the Consumer Financial Protection Bureau and How do I Complain?

CFPB – What is the Consumer Financial Protection Bureau and How do I file a Complaint?

If you have a complaint about your credit card company or a prepaid debit card issuer, then one way to report the fraudulent practices is to file a complaint with the Consumer Financial Protection Bureau.

Below, we have outlined the complaint procedure, and also added a helpful FAQ section about the CFTB.

The Consumer Financial Protection Bureau (CFPB) is a crucial federal agency in the United States that plays a vital role in protecting consumers’ financial rights and interests. Established in 2010 as a response to the financial crisis of 2008, the CFPB has since become a powerful advocate for consumers in the realm of financial services and products. In this article, we will delve into the functions and responsibilities of the CFPB and guide you through the process of filing a complaint with the bureau.

What is the Consumer Financial Protection Bureau?

The Role of the CFPB:

Regulatory Oversight:

The CFPB is responsible for overseeing various financial institutions and service providers to ensure they comply with federal consumer financial protection laws. These institutions include banks, credit unions, mortgage lenders, payday lenders, debt collectors, and more. By monitoring these entities, the CFPB works to prevent predatory practices and unfair treatment of consumers.

Consumer Education:

Another critical aspect of the CFPB’s mission is to educate consumers about their rights and responsibilities in the financial marketplace. The bureau provides resources, guides, and tools on various financial topics, helping consumers make informed decisions about their finances.

Research and Analysis:

To develop informed policies and regulations, the CFPB conducts extensive research and analysis on consumer financial markets. This research enables the bureau to identify emerging issues and areas where consumer protection may be lacking, ultimately leading to better regulatory decisions.

Rulemaking and Enforcement:

The CFPB has the authority to promulgate rules and regulations to address unfair, deceptive, or abusive practices in the financial industry. The bureau also enforces these rules by taking legal action against companies or individuals that violate consumer protection laws. This enforcement can result in penalties, fines, or other remedies for affected consumers.

Consumer Complaint Database:

One of the most accessible ways for consumers to interact with the CFPB is through its Consumer Complaint Database. This online platform allows individuals to file complaints about financial products and services, making it easier to address issues and hold companies accountable.

How to File a Complaint with the CFPB.

- Gather Information Before filing a complaint with the CFPB, it’s essential to collect all relevant information about the issue you’re facing. This includes details such as the name and contact information of the company involved, a description of the problem, relevant dates, and any supporting documents.

- Visit the CFPB Website To file a complaint with the CFPB, you can visit their official website at www.consumerfinance.gov. The website is user-friendly and provides step-by-step guidance on how to submit a complaint. You can also go directly to the Complaint Form here.

- Start the Complaint Process Once on the CFPB website, navigate to the “Submit a Complaint” section, which is usually prominently displayed on the homepage. Click on the appropriate category that best describes your issue, such as “Mortgage,” “Credit Card,” or “Debt Collection.”

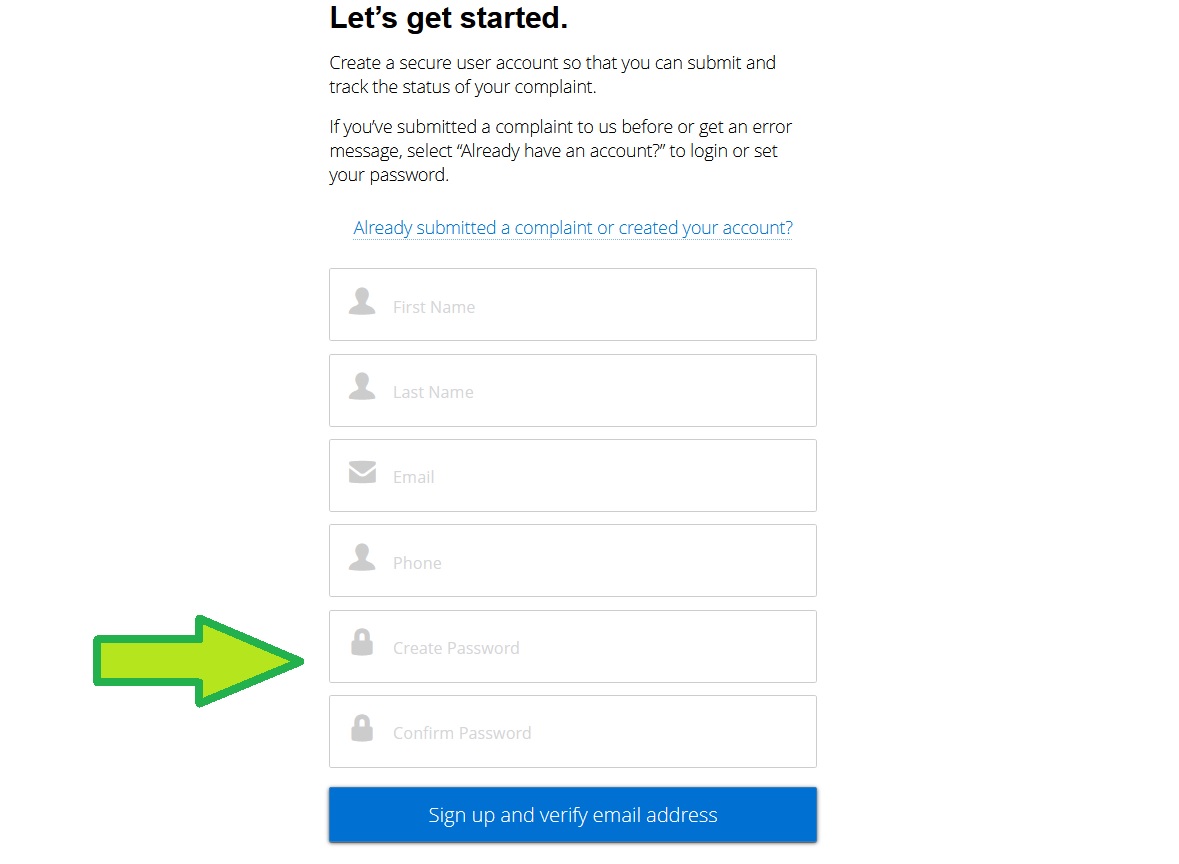

- Complete the Complaint Form Follow the prompts to complete the complaint form. You will be asked to provide information about yourself, the company you’re complaining about, and details about the issue. Be as specific and detailed as possible to ensure a thorough investigation.

- Submit the Complaint After filling out the complaint form, review the information to ensure accuracy and completeness. Once you are satisfied, click the “Submit” button to send your complaint to the CFPB.

- Tracking Your Complaint After submission, you will receive a unique reference number to track the status of your complaint. The CFPB will investigate the matter, work with the company in question, and aim to provide a resolution.

- Follow Up The CFPB will communicate with you throughout the complaint process. You may be asked for additional information or updates on your situation. It’s essential to respond promptly and provide any requested documentation to facilitate the investigation.

What can CFTB be used for?

The Consumer Financial Protection Bureau (CFPB) can be used for various purposes related to consumer financial protection and advocacy.

You can use the Consumer Financial Protection Bureau to file complaints about:

- Checking and savings accounts

- Credit cards

- Credit reports and other personal consumer reports

- Debt collection

- Debt and credit management

- Money transfers, virtual currency, and money services

- Mortgages

- Payday loans

- Personal loans like installment, advance, and title loans

- Prepaid cards

- Student loans

- Vehicle loans or leases

But the CFTB is not only used for filing complaints. Here are some of the key ways in which the CFPB can be utilized:

- Filing Complaints: Consumers can use the CFPB to file complaints against financial institutions and service providers. This includes issues related to mortgages, credit cards, student loans, auto loans, debt collection, credit reporting, and more. Filing a complaint with the CFPB can lead to the resolution of individual consumer problems and can also help the bureau identify trends and issues affecting a broader group of consumers.

- Accessing Resources and Information: The CFPB provides a wealth of educational resources and information for consumers. This includes guides, tools, and publications on various financial topics, such as budgeting, saving, borrowing, and managing debt. Consumers can use these resources to make informed financial decisions.

- Understanding Your Rights: The CFPB helps consumers understand their rights in the financial marketplace. This includes protections against unfair, deceptive, or abusive practices by financial institutions. Consumers can use the CFPB’s resources to learn about their rights under federal consumer financial laws.

- Seeking Assistance with Financial Issues: If consumers encounter difficulties with a financial institution or service provider and are unable to resolve the issue directly, they can turn to the CFPB for assistance. The bureau can help consumers navigate complex financial disputes and work with financial companies to resolve issues.

- Reporting Suspected Scams and Fraud: Consumers who suspect they have been targeted by financial scams or fraudulent practices can report their concerns to the CFPB. The bureau investigates such reports and takes action against entities engaged in fraudulent activities.

- Advocating for Policy Changes: Consumer advocacy groups and individuals can engage with the CFPB to advocate for changes in financial regulations and policies. The CFPB’s research and analysis help inform policymakers about consumer protection issues, which can lead to improved regulations and laws.

- Researching Financial Products and Services: Consumers can use the CFPB’s website to research and compare financial products and services, such as credit cards, mortgages, and student loans. This information can aid consumers in making informed choices that align with their financial goals.

- Staying Informed about Recalls and Alerts: The CFPB provides information on product recalls and alerts related to consumer financial products, such as credit cards, banking services, and mortgages. This helps consumers stay informed about potential risks or issues with financial products.

- Participating in Public Comment Opportunities: The CFPB often seeks public input on proposed regulations and rules. Consumers and stakeholders can participate in these opportunities to provide feedback and shape financial policies and regulations.

Which Type of complaints and crimes can I report to the CFTB?

The Consumer Financial Protection Bureau (CFPB) primarily focuses on addressing issues related to consumer financial products and services and ensuring that consumers are treated fairly and protected in their financial dealings.

While the CFPB doesn’t handle criminal matters directly, it can assist in addressing violations of federal consumer financial laws. Here are some examples of issues or “crimes” related to consumer financial matters that you can report to the CFPB:

- Unfair, Deceptive, or Abusive Acts or Practices (UDAAP): You can report situations where financial companies engage in unfair, deceptive, or abusive practices. These can include misleading advertising, deceptive loan terms, hidden fees, or practices that harm consumers unfairly.

- Predatory Lending: If you believe you have been a victim of predatory lending practices, such as excessively high interest rates, hidden fees, or loans with terms designed to trap borrowers in a cycle of debt, you can report it to the CFPB.

- Debt Collection Abuses: You can report issues related to debt collection, including harassment, false or misleading information, or attempts to collect on debts that you don’t owe.

- Credit Reporting Errors: If you believe there are errors on your credit report that are negatively affecting your credit score or causing other financial harm, you can report these issues to the CFPB.

- Mortgage Servicing Problems: If you have issues with your mortgage servicer, such as problems with loan modifications, escrow accounts, or foreclosure procedures, you can report these issues to the CFPB.

- Student Loan Problems: If you encounter problems with your student loans, such as issues with loan servicing, incorrect billing, or difficulties accessing repayment options, you can report them to the CFPB.

- Identity Theft and Fraud: While the CFPB doesn’t investigate or handle criminal identity theft cases, it can assist in addressing issues related to financial accounts and services affected by identity theft and fraud.

- Financial Scams and Fraud: If you have been a victim of financial scams or fraud related to consumer financial products and services, you can report these incidents to the CFPB.

Fraud and identity theft cases should be reported to law enforcement agencies, such as your local police department or the Federal Trade Commission (FTC).

CFTB FAQ:

Frequently Asked Questions about the Consumer Financial Protection Bureau:

1. What is the CFPB, and what is its mission?

The CFPB, short for the Consumer Financial Protection Bureau, is a federal agency in the United States. Its mission is to protect and empower consumers in the financial marketplace. The CFPB achieves this by enforcing consumer protection laws, regulating financial institutions, providing consumer education, and handling consumer complaints.

2. When was the CFPB established, and why?

The CFPB was established on July 21, 2010, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. It was created in response to the 2008 financial crisis to address issues of consumer financial protection and to ensure the fair treatment of consumers in their interactions with financial institutions.

3. What types of financial institutions does the CFPB regulate?

The CFPB regulates a wide range of financial institutions and service providers, including banks, credit unions, mortgage lenders, payday lenders, debt collectors, credit reporting agencies, and more. Its aim is to ensure these entities comply with federal consumer financial laws.

4. How can I file a complaint with the CFPB?

You can file a complaint with the CFPB online through their official website (www.consumerfinance.gov). The process involves selecting the appropriate category that describes your issue, providing detailed information, and submitting your complaint. The CFPB will investigate your complaint and work to resolve it.

5. What types of issues can I file a complaint about with the CFPB?

You can file a complaint with the CFPB related to a wide range of consumer financial issues, including problems with mortgages, credit cards, student loans, auto loans, debt collection, credit reporting, and more. If you believe you have been treated unfairly by a financial institution, you can file a complaint.

6. How long does it take for the CFPB to resolve a complaint?

The time it takes for the CFPB to resolve a complaint can vary depending on the complexity of the issue and the cooperation of the parties involved. In many cases, you will receive a response from the CFPB within 15 days, but some cases may take longer. The CFPB will keep you updated on the progress of your complaint.

7. Does the CFPB provide consumer education resources?

Yes, the CFPB offers a wide range of consumer education resources. These include guides, tools, publications, and information on topics such as budgeting, saving, borrowing, managing debt, and understanding your financial rights. These resources are available on their website for free.

8. Can the CFPB assist with financial disputes and problems?

Yes, the CFPB can assist consumers with financial disputes and problems. If you are unable to resolve an issue with a financial institution directly, the CFPB can help mediate the dispute and work with the company to find a resolution.

9. How does the CFPB protect consumers from unfair or abusive financial practices?

The CFPB protects consumers through the enforcement of federal consumer financial protection laws. It has the authority to promulgate rules and regulations to prevent unfair, deceptive, or abusive practices by financial institutions. It also takes legal action against companies or individuals that violate these laws.

10. Is there a cost to using the CFPB’s services, such as filing a complaint or accessing educational resources?

No, using the CFPB’s services, including filing a complaint and accessing educational resources, is generally free of charge. The CFPB is funded by the federal government and provides its services to consumers at no cost.

11. Can the CFPB help with issues related to credit reporting errors?

Yes, the CFPB can assist with issues related to credit reporting errors. You can file a complaint with the CFPB if you believe there are errors on your credit report that are negatively affecting your credit score or causing financial harm.

12. How can I stay updated on CFPB activities and news?

You can stay updated on CFPB activities and news by visiting their official website (www.consumerfinance.gov) and subscribing to their email updates. The CFPB regularly publishes reports, news releases, and updates on consumer financial issues.