How to Avoid Compromised Prepaid Gift Cards

How to Avoid Prepaid Gift Cards that have been Tempered with.

For a long time, consumers have been cautioned about the dangers of gift card scams. However, an emerging menace now centers around the very racks that hold these gift cards in retail stores. Store displays often become the focal points for financial tricksters seeking to make a quick profit.

In 2022 alone, Americans reported losses totaling $228.1 million due to scams related to gift cards, according to the FTC Consumer Sentinel. It is imperative that consumers take action to report and combat this crisis before it spirals further out of control.

Scammers now simply tamper with gift cards on display racks within stores: They accomplish this by covertly recording the activation code on the card. Subsequently, they can convert this code into cash or credit by activating it online, all without the knowledge of the legitimate card purchaser.

Ordinarily, consumers go online after purchasing a gift card to acquaint themselves with any rules or restrictions associated with the card. Often, they discover that these cards have been compromised and completely depleted of their value.

Gift cards indeed offer a convenient and practical way to give gifts, but it is crucial for consumers to understand that scams involving display rack gift cards are common and have personal consequences. These scams not only result in financial losses but also generate emotional distress and frustration. Not only is it annoying for a recipient of a compromised gift card, it is also embarrassing for a gift-giver to having gifted a drained card.

It is worth remembering that dedicating a few extra moments to inspecting a gift card before purchasing it can save a great deal of trouble in the long haul.

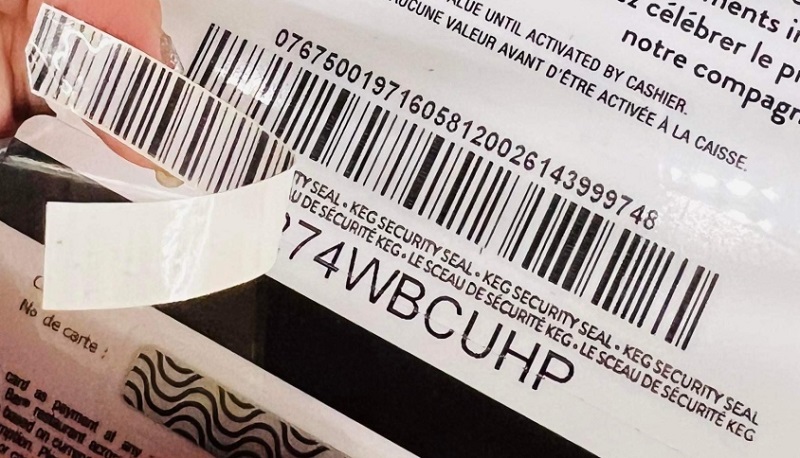

Check the Packaging:

Be vigilant for any signs of tampering, such as torn or resealed wrapping. Also, scrutinize the barcode or card number for any stickers that seem out of place. Scammers frequently affix a counterfeit barcode sticker over the actual barcode of the gift card. This deceptive tactic enables them to transfer the funds to their own card right after your purchase.

Tips for Evading Tampered Prepaid Gift Cards:

- Select a card from the rear of the display: Fraudsters often position their deceptive cards at the front of the display. Opting for a card from the rear can diminish the risk of procuring a tampered card.

- Purchase gift cards within the cashier’s view: Gift cards that remain within sight of the cashier offer a safer choice, as they are less likely to have been tampered with. Furthermore, if gift cards are kept behind the counter or in a securely locked display case, they provide an additional layer of protection against tampering.

- Exercise caution with unfamiliar brands: If you’re unfamiliar with the brand featured on the gift card, conduct some research before making a purchase. Some scammers manufacture counterfeit gift cards for nonexistent or defunct brands, necessitating caution.

Report Suspicious Activity:

If you have a suspicion that a gift card is fraudulent or has been tampered with, promptly report it to a store associate and request a refund or exchange. Furthermore, report the incident to the Federal Trade Commission (FTC) and contact the company that issued the gift card to request a replacement.

Other Prepaid Gift Card Scams and Prepaid Debit Card Scams:

- Advance Fee Scam.

This represents a modernized variant of the traditional wire transfer scheme. Instead of using the postal service, scammers employ email to perpetrate this crime. Employing a phony email address, criminals coerce victims into paying an upfront fee to receive a prepaid card preloaded with cash, among other things.

- Card Reloading.

In this cunning scam, a criminal contacts a merchant via phone or email, claiming to be a representative of their payment processor or alternatively, the issuing bank, company or credit institution. With the stolen prepaid debit card information in hand, the scammer pretend to have issues with card loading. The perpetrator goes to great lengths to appear credible. An unsuspecting merchant or staff member reloads the card electronically, allowing the scammer to siphon off money into another account or simply withdraw the money directly using an ATM. In some cases, the online shop or company may reload the card multiple times before they are able to detect the fraud.

- Card Skimming.

This scam involves a fraudster loading a gift card or prepaid card with data stolen through a magnetic stripe reader. When an unsuspecting consumer purchases and activates the gift card, the scammer pilfers the card number and exploits the funds for purchases or withdrawals.

- Card Swapping.

Card swapping entails a scammer getting a hold of a stack of physical cards and duplicating or altering their numbers. The fraudster subsequently returns the cards to the store, placing them back on the rack. Upon a customer’s purchase and card loading, the perpetrator can deplete the account’s funds before the customer even exits the store.

- Tax Return Fraud.

Many tax return services offer prepaid cards as a means of disbursing tax refunds to individuals without checking accounts. With a stolen ID profile, a scammer can simply fill out tax forms and designate a prepaid credit card or debit card to receive the tax refund themselves.

As always, be vigilant. And share your experiences and advice in the comment section.